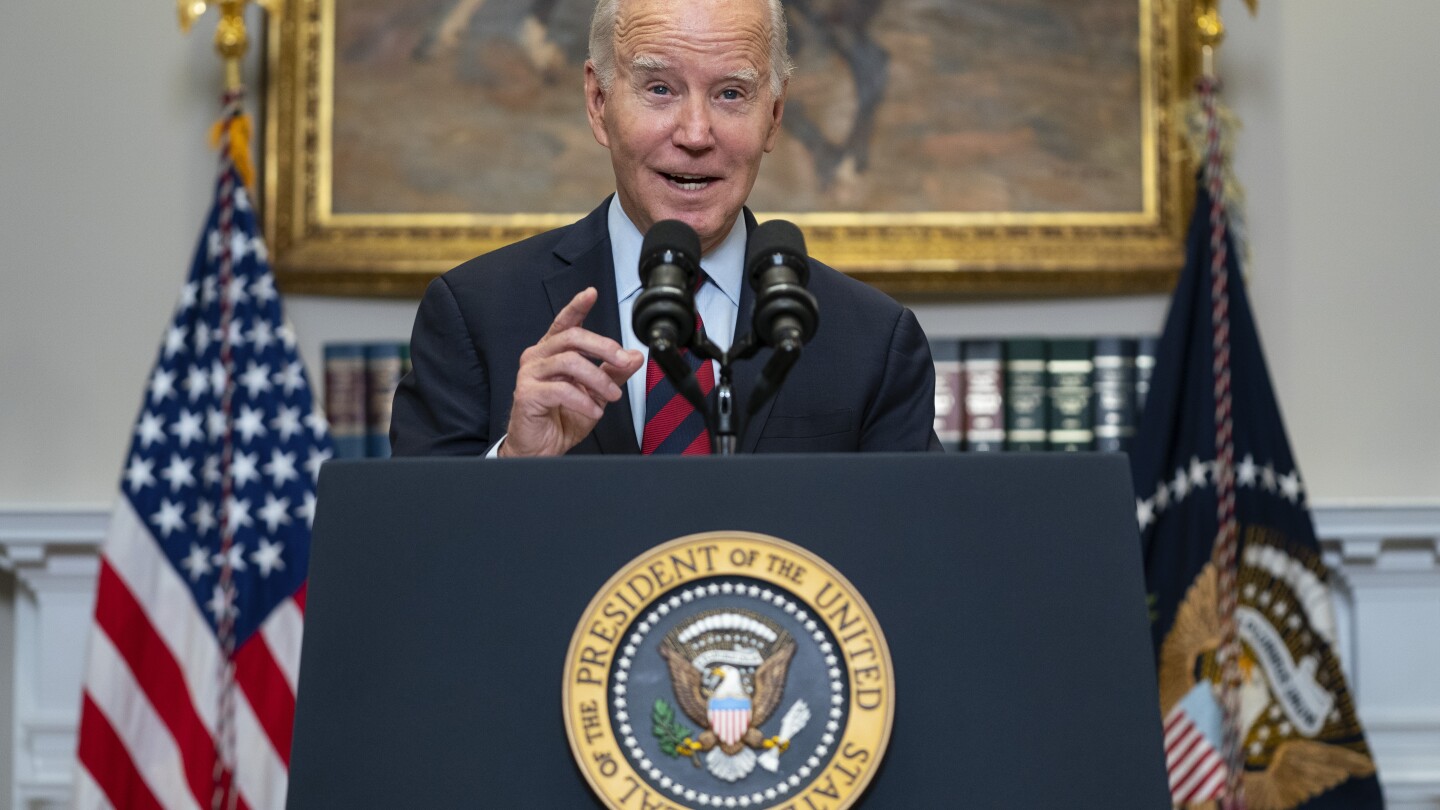

Americans who are struggling to repay federal student loans because of financial hardship could get some of their debt canceled under President Joe Biden’s latest proposal for widespread loan forgiveness.

Several categories of borrowers would be eligible for relief under Biden’s second try at widespread cancellation after the Supreme Court rejected his first plan last year. Those with older loans or large sums of interest are being targeted for relief, for example. On Thursday, the Education Department expanded its proposal to include those who face financial hardship.

The plan was expanded amid pressure from advocates and Democrats who said the proposal didn’t do enough for struggling borrowers who don’t fit into one of the other cancellation categories.

is the definition of hardship static or is it scaling?

It’s going to have to be defined as “as much as they think they can do without having to go through congress.” Since nothing gets through congress these days.

Definition is somewhat vague still, the draft text is here:

Likely vague on purpose so the secretary of education can be flexible in setting the exact terms.

when the Secretary determines that a borrower has experienced or is experiencing hardship related to such a loan such that the hardship is likely to impair the borrower’s ability to fully repay the Federal government or the costs of enforcing the full amount of the debt are not justified by the expected benefits of continued collection of the entire debt.

There 17 different potential factors for hardship listed that could be considered, including “other.”

Sounds like they should at the very least allow it to be discharged in bankruptcy. As that’s exactly what desperate people to with untenable debt. But hopefully this accounts for the majority of people who simply can’t afford to ever repay their loans.

Guess who made it so student loans dont get discharged in bankruptcy

https://www.theguardian.com/us-news/2019/dec/02/joe-biden-student-loan-debt-2005-act-2020

It’s correlated to the White House’s evolution of the terms inflation and recession

This carrot has been dangeled before… Sure, the guy who manufactured this problem will surely fix it…

https://www.theguardian.com/us-news/2019/dec/02/joe-biden-student-loan-debt-2005-act-2020

This is a literal write-off, the plan so far is to only forgive their lowest quality loans that are either defaulted or will in next 2 years, aka another bailout due to poorly underwritten loans (Privatize the gains, socialize the losses). Every Month I hear about how either Biden waived oh so many student loans, or how is he going after whats left, never how he refuses to take executive action to get rid of the loans he promised to get rid of while campaigning. Meanwhile Biden can use executive action to fund Israel’s genocide, but not the student loans that many people say he won on. I do not feel represented by these kinds of actions and can not support them, we can fund Genocide and Bank losses but not the regular joe.

So, it’s useless because it didn’t benefit you? Are you serious?

I am arguing that it is useless because it is really only benefitting the banks by paying off their worst loans. If this was about regular folks why is it limited to loans that would be losses to banks and not to say everyone?