We live in an interconnected world. As an American, I’d like to know some ways that I could purchase goods, in solidarity with our brothers and sisters in Canada and Mexico, and still avoid the tariffs.

A) Visit the country you want to support

B) Stop buying so much stuff

I’m not trying to throw any shade at you, but it’s kind of sad when the the question isn’t “how do I get by without buying stuff,” but rather “what can I buy more of to improve the situation?”

Buy lots of fentanyl ?

We’re all gonna being paying tariffs in solidarity together, homes. This whole debacle is such a stupid self-own for America that costs us AND everyone else.

All that sweet, sweet tariff money, just flowing into the govt for Elon to use as a slush fund. Or whatever other superb galaxy brained idea comes up.

Holmes**

You can continue to buy goods with tarrifs to support the canadians, the price for you to support them is the tariff

The problem is that the tariff you support with ends in the wrong pockets…

If it’s a good that the USA has implemented an import tariff on then the tarrif supports the USA not the other country. Buying the goods still supports them sure, but not the tariffs.

Right. The tariff is the price you pay to support them.

deleted by creator

Which products is Canada putting an export tarrif on? This is news to me.

Most produce and animal products are 25% energy is 10%

I only asked my question because the original commentor was suggesting that US prices were going to go up because Canada was adding export tarrifs.

I assume that because they deleted their comment they realized that wasn’t true.

Brilliant! Took me too long, but I’m on the same page now.

Help me

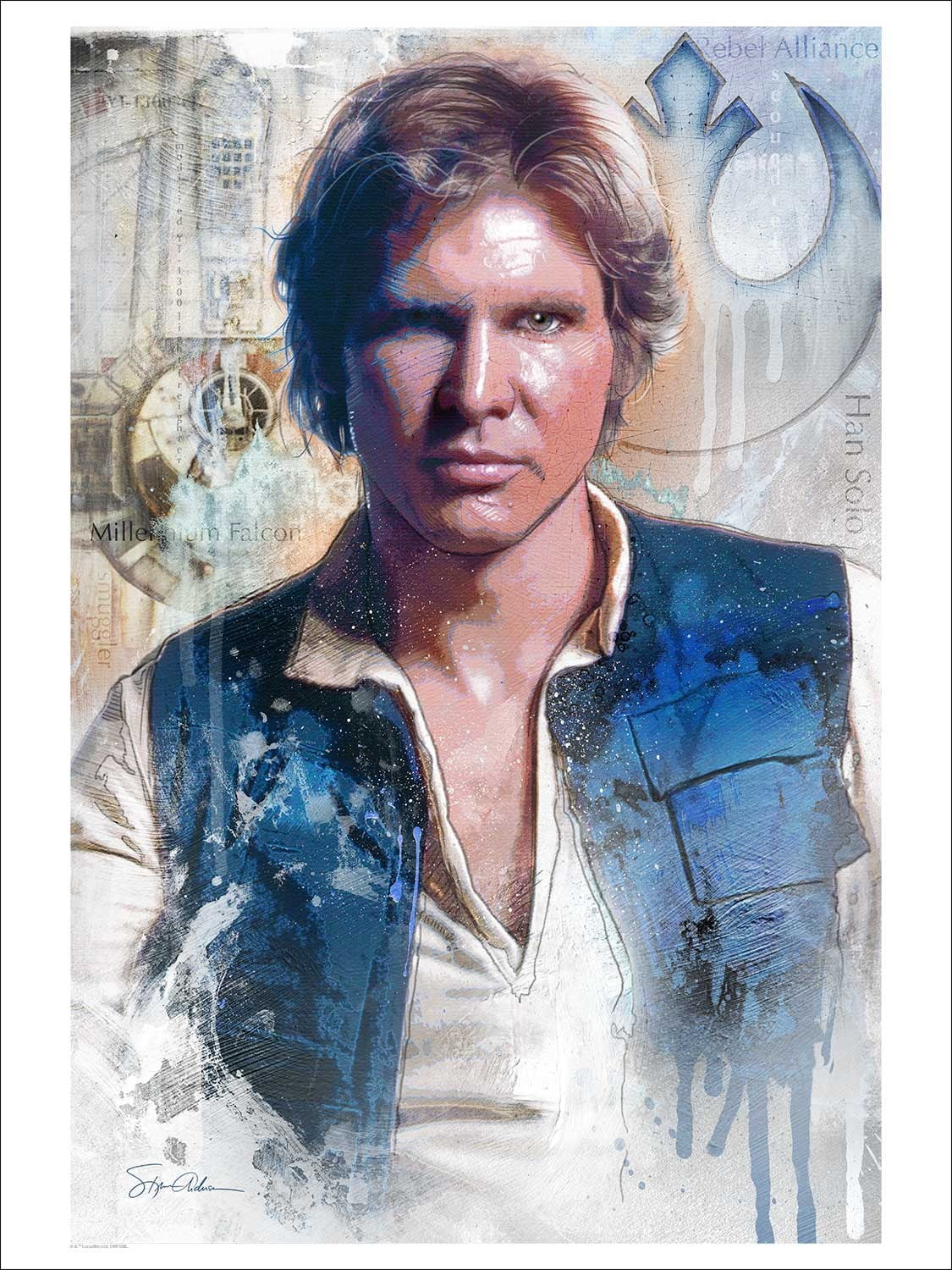

Kessel Run. In less than 12 parsecs.

Smuggling

First, thank you!

There’s a website that’s kind of helpful:

Basically, digital stuff is probably the easiest. And as others have pointed out, visiting helps!

Traveling out of the USA.

Yea, come take a vacation up here. No tariff on that at all.

Just got back from beautiful Canada 2 weeks ago! I was delighted to spend time with my wonderful brothers and sisters we met along the way in Canada.

What I’m really interested to know is if at border crossings, individual will or will not have to pay duties on purchases in Canada. Previously it was only on liquor or cigarettes over a certain amount. Now will I have to declare I bought a pair of shoes in Canada from Softmoc, a tank of gas from Canadian Tire, or a bottle of maple syrup from Quebec paying addition taxes on all of these to bring them back to the states? Do you know how hard it is to find peameal bacon in the USA?

If you spent 48 hours or more abroad then you can claim an $800 exemption from duties. This is the case for both Canada and the US (except the dollars is the respective currency). USA gets a fixed $200 exemption for every crossing if the other one doesn’t apply, Canada requires a 24 hour minimum stay for any exemptions, but in practicality if you tell CBSA you have around $200 of stuff that isn’t alcohol, most (especially at road/rail borders) will just wave you through without needing to fill out duty forms and pay.

The personal exemption should still exist, but I didn’t actually look that up.

As a matter of fact, the day after the election, I decided that I would drive from my northern midwest state to Washington via Canada. Next year, I’m planning on a maritimes road trip.

You’ll have to pay a 25% tax on yourself when you return, though.

(/s, until someone figures out how to actually do that)

Border officers will measure the weight of every travelers, in and out of every countries. Then, after estimating how much per kilogram they estimate themselves, travelers will have to pay tariffs on the weight difference.

Excessively low estimates could expose travelers to “harvesting” by some rich Nazi who would buy them out (literally !).

/sarcasm (i certainly hope this remains sarcasm forever.)My understanding is that some province is charging double on US commercial trucks that cross the border. Nova Scotia?

Not a border crossing but Nova Scotia’s toll road, the Cobequid Pass is doubling rates specifically for US commercial vehicles.

I don;t believe NS shares a border with the US unless perhaps a fairy but I have no idea if there are any US to NS ferries.

It doesn’t. Might have been New Brunswick. Or I just made it up somehow. I can’t remember where I saw it.

They charge something like $11 USD to cross border bridges (at least in Detroit and Sarnia).

The exchange rate is likely to be prohibitively stupid once all this gets rolling.

You don’t avoid tariffs per se. When the good enters the country, the tariff is paid to customs. It’s just an import tax. Now to recoup the loss from that tariff, it will be sold to you at a markup. You can still pay Canadian and Mexican goods, but the best thing you can do is optimize shit where you live.

My recommendation to you would be to buy less if you can help it. Don’t use Amazon if you can help it. Legumes, grains, dairy, produce, water, cheap protein, all bought locally. If you can purchase from illegals even better. I got this guy that sells me honey on my way back from work. It’s fire. Look at it as a little challenge you impose on yourself. You don’t need to do it perfectly. If enough people do it imperfectly, the corporate concerns that got you all into this mess will feel the hurt.

Is “illegals” supposed to be “people without permits”?

I’m a bit suprised to see that phrasing used on lemmy, it’s incredibly dehumanising.

Actually the preferred term is illegal aliens. I omit the latter because calling a human being an alien is the actual dehumanising part. Spare me the insipid fuckin moralisation.

I think “illegals” is just as dehumanising as “illegal aliens”. And what the government uses is kind of irrelevant to that, governments have a long history of labelling marginalised groups with dehumanising terms.

I think “undocumented migrants” or “unofficial migrants” or “people without residency” etc would be better.

If you happen to be close enough, buy Canadian goods in Canada.

The only way to avoid the tariffs is to avoid any goods that cross borders during or after manufacture.

To still buy foreign products without paying the tariffs, you’ll have to buy those goods outside the US. Then, of course, you have the difficulty of getting them back into the country without, you know, paying tariffs.

Wait. I can’t go to Canada, buy a jacket for 20 CAD, and bring it back to the US without paying a tariff on it?

There’s a duty limit of $200 for a one day trip, unless they’ve changed it. Two day trips are $800.

Everything you buy over the limit should be declared and taxed. If you fail to declare something and get caught you’ll be fined for smugling.

Tariffs are not flat across the board. If it lasts, we’re going to see a lot of shell companies popping up in strategic places for the purposes of avoiding/reducing taxes paid.

Depending on the exact details, these may be little more than reshippers. Or they could be like the products that are “Made in the USA (from imported components)”

I happen to be road tripping to west coast this summer and will be going north to canada and then west. I need a new winter coat so I’ll be picking one up while in Canada.

One coat would keep you warm

Twenty would keep you very warm.

That would be tax evasion and highly illegal. Their is a reason governments hate XMR.