PREFACE – A quick little short squeeze

SOME OF THE GREAT DD AND ITS CONNECTION TO GAMESTOP AND THE STOCK MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

- What is a share and where is it held?

- How many entities technically have access to a share?

- Where are the shares traded and how is the price derived?

- How regular people think price discovery works and how it actually works?

WHAT NEEDS TO CHANGE FOR A FAIR MARKET

HOW LONGS WIN THIS WAR – SOMETHING THEY WILL NEVER FORGET

But how can longs win over shorts? Is a successful turnaround enough? Did for example naked shorts bleed with the Tesla meteoric rise in share price or did they just switch sides and end up earning even more money? Is pure DRS enough? How is the system working today anyway and what needs to change?

To answer those questions we will dive in:

-

What is a share and where is it held?

-

How many entities technically have access to a share?

-

Where are the shares traded and how is the price derived?

-

How regular people think price discovery works and how it actually works?

-

What is a share and where is it held?

A share of a company consists of voting and economic rights. Vote on the annual meeting and thus have direct influence of who runs the company and indirect to the strategy and organization

Economic right is the right to own and you would think also to buy and sell. But the right to buy and sell is not attached to a share but rather in combination with an exchange and a broker-dealer, e.g. the right to buy was removed per brokers during January 21 and in general with places like “the expert market”, where only a few brokers allow individual investors to buy, while one can sell anytime. Also some brokers (maybe the minority) allow one to select an exchange or OTC to place your order while some don’t.

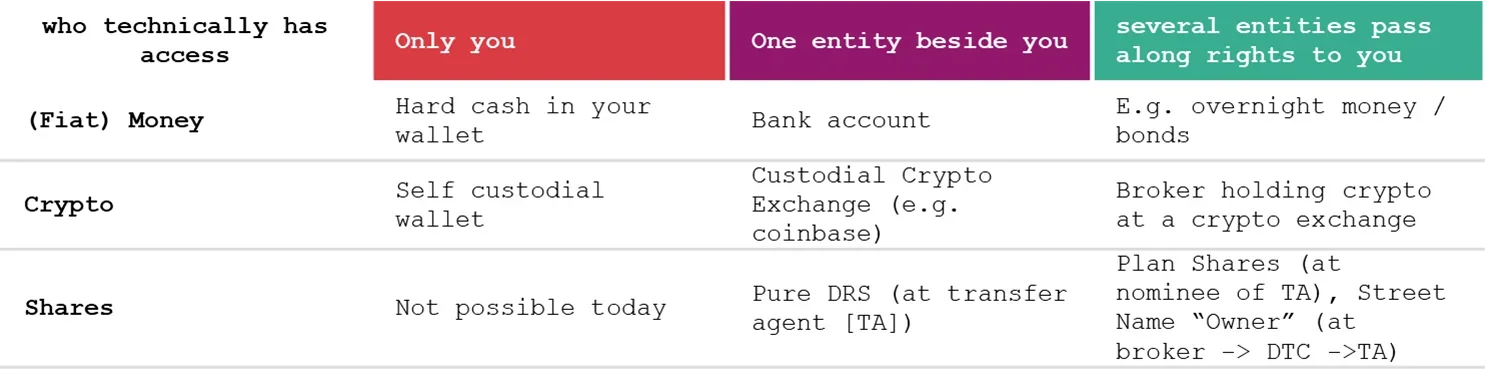

Like with money you can decide where to hold your shares. Money can be held as hard cash in your wallet, in a bank account or even be invested and held in a derivative (e.g. overnight money). Thus, when giving the money to another party it becomes clear that they are technically able to do something with it, e.g. loan or invest it. This could technically be done without your consent, which might be legally required or not. So the next question is when changing the way to hold an asset (money or shares) how many entities have technically access to it.

- How many entities technically have access to a share?

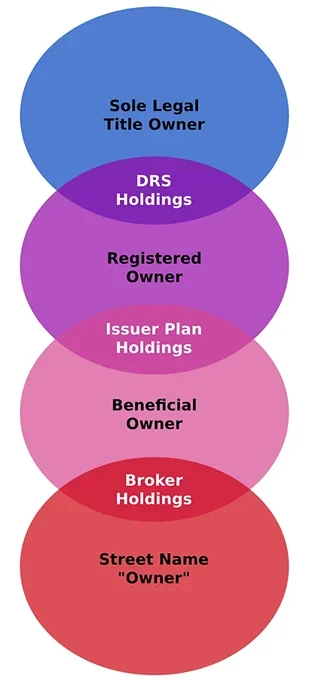

The place the share is held also defines how many entities technically have access to the share. Legally that’s a different story, but see with a broker-dealer you are holding an entitlement as beneficial owner. For Transfer Agent Regulations the SEC called for comments on transfer agent regulation in 2015, since current regulations are from 1977 (https://public-inspection.federalregister.gov/2015-32755.pdf, p. 1) . Obviously, no regulation was put into action and there is rather no action and meetings since 2019. Looking at what the SEC already state in 2015 is that shares maybe not safe with a transfer agent and issuer plan are typically not in the name of the investor (p. 194 and https://www.sec.gov/about/reports-publications/investor-publications/holding-your-securities-get-the-facts). Bibic-jr created this wonderful graph in showing the differences in the ways of holding shares:

Yet, it bugged me that all of those ways include at least one counterparty who technically has access. So I added one more step and compared the amount of entities having technical access with Money, Crypto and Shares:

Who should have access to your equity? Here’s how to hold for your preference:

Wait a minute… so DRS is not the way? Indeed, it’s the only way. DRS and DWAC transfers into Direct Registration might be the only way out of this fraudulent system… Still, one entity beside you always has access and could in theory also remove the buy button. Can MOASS happen with another entity having access? I don’t know and I repeat, without DRS we are stuck in the system with DTC.

Some may also ask, wait but Plan is equal to Pure DRS isn’t it? Well the SEC said “[t]o hold in DRS once [plan shares] are acquired, you would need to instruct the transfer agent to move the securities from the issuer plan to DRS” (https://www.sec.gov/about/reports-publications/investor-publications/holding-your-securities-get-the-facts), since share plans (dividend reinvestment, direct stock purchase, etc.) could not be considered your property (https://www.sec.gov/comments/s7-27-15/s72715-40.pdf, p.12). Also finra says that “[y]ou’ll need to instruct the transfer agent to move [bought plan shares] to the DRS” https://www.finra.org/investors/insights/know-the-facts-direct-registered-shares.

Next, to exercise the economic right to buy or sell there must be an economic value, which is detached from the share and the place it is stored.