DRS in Millions (10-Q & 10-K)

- 10/30/21 20.80

- 01/29/22 35.60

- 04/30/22 50.80

- 07/30/22 71.30

- 10/29/22 71.80

- 03/22/23 76.00

- 06/01/23 76.60

- 08/31/23 75.40

DRS in Millions (What if Cede Would Lie?)

- 10/30/21 20.80

- 01/29/22 35.60

- 04/30/22 50.80

- 07/30/22 71.30

- 10/29/22 71.80

- 03/22/23 103.2382

- 06/01/23 114.7828

- 08/31/23 129.5794

It might be hard to visualize, but the last 3 fake data points do include a smaller slope by including the data point where we “only” added 0.5M in October of 2022.

But what if Cede fucked with the reporting for October specifically, knowing that the last 2 real data points (71.3 and 71.8) would only show a slope of ~0.5M a quarter?

Why do youyouyou think Gamestop changed the wording from 03/22/2023 onward?

Further ruminating, using very conservative numbers.

Not even using 200,000 Computershare accounts. Say just 100,000 accounts.

Is it a stretch to say 100,000 accounts DRS 5 shares a month? 100,000 x 5 shares a month x 3 months = 1,500,000 a quarter

5 shares a month * $22 avg = $110 a month * 3 months = $330 a quarter

Or only 1 to 3 shares a month for 200,000 accounts:

- 1 share a month = 600,000 a quarter

- 2 shares a month = 1,200,000 a quarter

- 3 shares a month = 1,800,000 a quarter

Those are very reasonable (and very conservative) numbers.

As the quarters continue, I think it will become much more apparent that the wording change changed something significant.

As someone that knows nothing, my conjecture is that Gamestop changed the wording either as a ‘favor’ to the SEC or because they knew the numbers provided by computershare or cede were fundamentally wrong, but couldn’t call it out directly.

It seems the underlying question is if the DTCC has any effect on what Computershare provides GameStop for the DRS numbers.

I’m assuming Computershare the transfer agent keeps its own share count and provides the information to GameStop.

- Computershare -> GameStop

Assuming there is no DTCC step where the DTCC tells Computershare what’s on DTCC side, so Computershare has to fudge their numbers to match, then tell GameStop.

Has there been any information that shows the flow of share count data is:

- DTCC -> Computershare -> GameStop

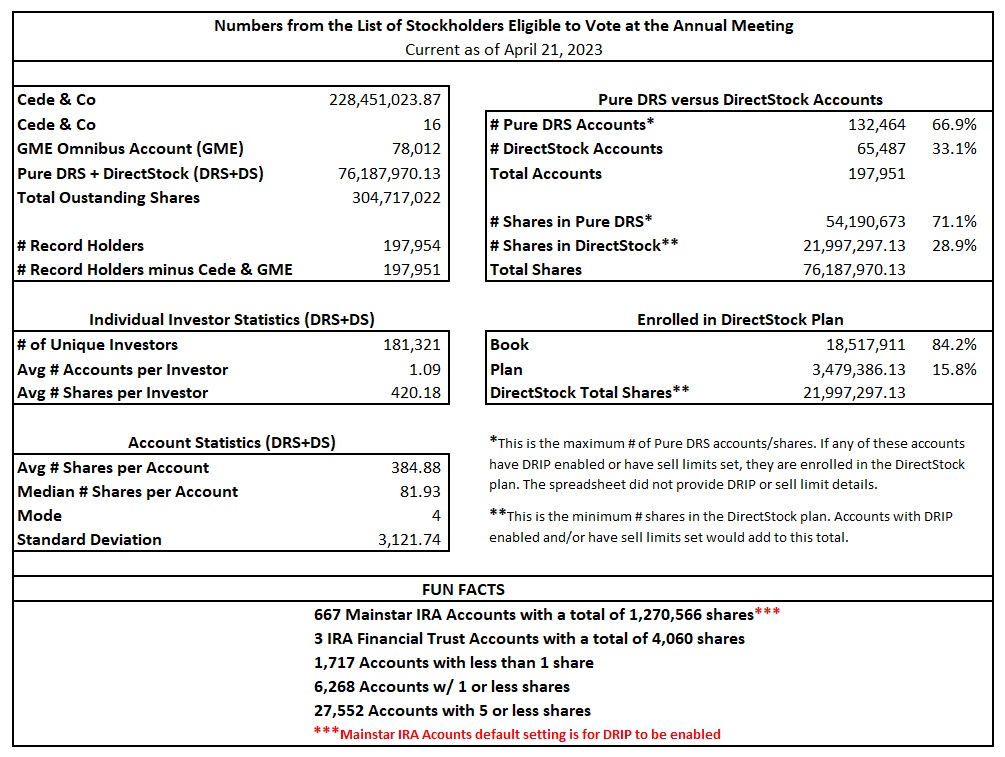

If we include the non-official DRS numbers with the official GameStop SEC filings:

Date DRS in Millions Notes 10/30/21 20.80 SEC filing 01/29/22 35.60 SEC filing 04/30/22 50.80 SEC filing 05/26/22 47.01 List of stockholders 07/30/22 71.30 SEC filing 10/29/22 71.80 SEC filing 03/22/23 76.00 SEC filing 04/21/23 76.26 List of stockholders 06/01/23 76.60 SEC filing 06/20/23 75.33 Mainstar rugpull -1,270,566 08/31/23 75.40 SEC filing The May 2023 visit to GameStop HQ for the 04/21/23 list of stockholders numbers:

Using your numbers:

- 10/29/22 71.80

- 03/22/23 103.2382 - would be like 31.4 million shares times $25 average = $785,000,000

- 06/01/23 114.7828 - like 11.54 million shares times $21 average = $242,340,000

- 08/31/23 129.5794 - like 14.8 million shares times $22 average = $325,600,000

From a dollar amount $1,352,940,000 / 200,000 Computershare accounts = $6,765 each / $22 avg = +308 shares each over 10 months (31 shares a month).

Plausible, but it may be tough for the average holder to spend $676 a month on GME shares. And without the whales buying as much as they initially did, it skews the numbers down too.

I’m looking at the Numbers from the List of Stockholders you provided, and there are some wild statistics. For example the ‘mode’ for # of shares is 4 but the Std. Deviation is 3,121.

I noticed these too. I personally don’t take their estimation posts to heart because the calculations are inherently based on the numbers I’m saying are not being accurately relayed to us.

Therefore, what happens to drsed shares over the actual count?

To me, something new will need to be issued, to include those supporters and to reset the count with a factually-compliant issuer.

Which we inow cannot be one of those that exist now